Faith

Poverty is not God's design. We work to see people experience the abundant life God desires for us.

We work to break down barriers that prevent entrepreneurs & business owners in marginalized communities from realizing their God-given potential.

Join us in ensuring that entrepreneurs have access to everything and everyone they need to lift their families from the vulnerabilities of poverty.

We’re a global Christian network using business to fight poverty - rooted in faith, focused on jobs, built on partnership.

Poverty is not God's design. We work to see people experience the abundant life God desires for us.

Today, over 700 million people live in extreme poverty. Together, we can do something about it.

Jobs transform lives. Through business, entrepreneurs earn incomes, employ workers, and live out their calling.

We all have something to offer. Ending poverty requires interdependence and reciprocity.

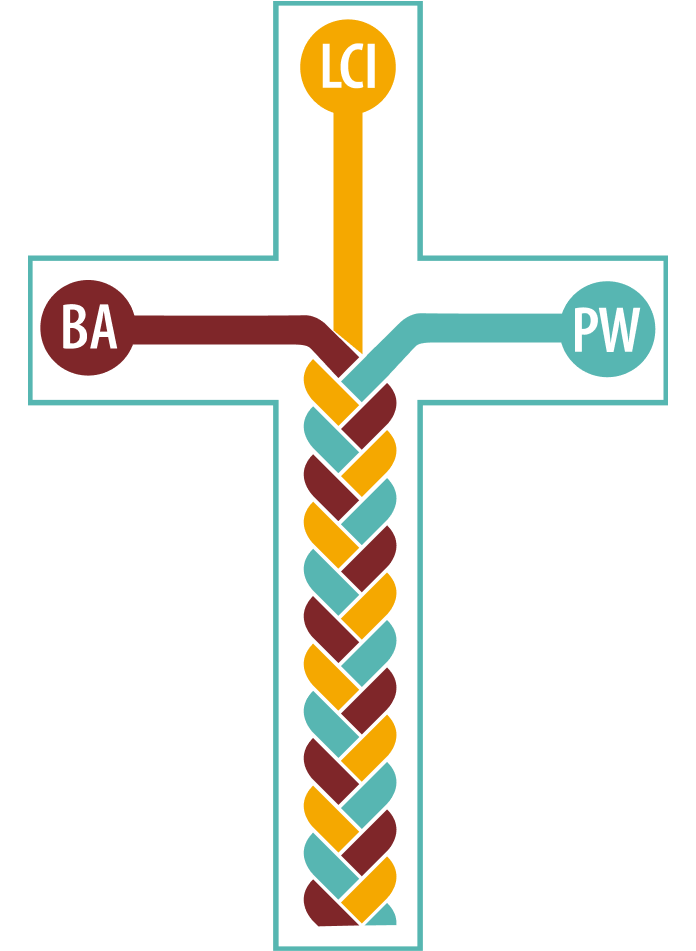

We can only end poverty together. Our unique partnership model mobilizes long-term, hands-on, global relationships to form a powerful Christian network.

We work together, not alone, and benefit from the experience, background, and passions of those involved. Learn about the three key entities that make our model work.

This is our term for our local partners. They are independent, locally-owned and led organizations working to end poverty through business in their communities.

These passionate individuals and groups of volunteers collaborate with Local Community Institutions to develop concrete plans, share expertise, and provide financial support and spiritual encouragement.

Our global team is the catalyst for our network. We identify new Local Community Institutions, orient and equip Business Affiliates, facilitate existing and emerging partnerships, and grow our network.

Partnership is how we fight poverty. We work side by side with local partners, listening first, then responding together. Within each relationship, we draw on tools and experience from our global network to support entrepreneurs and strengthen local economies. Our work focuses on making sure entrepreneurs have access to markets, knowledge, relationships, capital, and business ecosystems - everything and everyone they need to thrive and grow.

We develop and help implement business training curricula based on biblical principles for micro and small to medium enterprises.

We foster relationships and expertise to grow strong, resilient local institutions and businesses. We recruit experienced businesspeople and professionals to join and support our global network.

Through local partners, we offer funding for loans to entrepreneurs. We also invest in strategic projects in our network that provide new ways to support entrepreneurs.

We leverage long-term relationships that go beyond individual connections to create collaborative networks. By bringing together multiple partners across regions and countries, the impact is multiplied.